Spread in Forex is the difference between the bid price and the ask price. The Spread cost is measured in ‘pips’ and is the cost of trading. Popular currency pairs such as the EUR/GBP and USD/AUD have lower spreads as a result of higher levels of liquidity. An in-depth explanation can be found in our Beginner’s Guide To Forex Trading.

Spread in Forex is the difference between the two prices of a currency pair. The Bid is the quote price at which a trader is willing to buy an asset, and the Ask level is the quote price at which a trader is willing to sell an asset. Organised by way of a two-way quote, signify willing buyers and ask prices determine willing sellers. This concept is fundamental for traders to comprehend as they are the primary cost of trading forex and currency pairs.

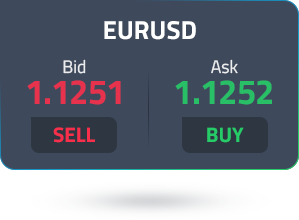

For instance, if the bid/ask rate for the EUR/USD is 1.1251/1.1252. Here, EUR is the base currency and USD is the quote currency. This means that you can buy the EUR at a higher ask price of 1.1252 and sell it lower at the bid of 1.1251.

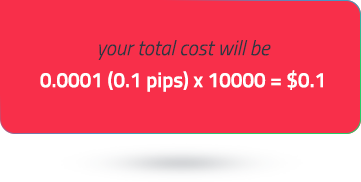

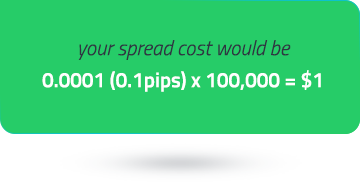

The difference between ask and bid price in forex is known as the spread. In the above example, the spread in pips would be (1.1252-1.1251) = 0.0001. The pip value on USD-based pairs is identified on the 4th digit, after the decimal. This means that the final forex spread is 0.1 pips.

To calculate the total spread cost, multiply this pip value by the total number of lots traded. So, if you are trading a EUR/USD trading lot of 10,000. In case you are trading a standard lot (100,000 units of the currency). Now, if your account is denominated in another currency, say GBP, you will need to convert that from US Dollars.

Given the bid and ask prices traders can engage with the market immediately or on the spot. The ask price is slightly higher than the underlying market price, whereas the bid price is slightly below the underlying market price. Traders sell the bid and buy the ask. A narrower bid-ask spread translated to lower trading costs.

The size of the spread plays a pivotal part in forex trading. This is particularly the case for those using trading strategies that conduct a large number of transactions in a single trading session. Trading volume, liquidity, market volatility, news, and time can all have an impact on spreads.

The spread affects profit, given that a currency pair reveals information about market conditions such as time, volatility and liquidity. For instance, emerging currency pairs have a greater spread than major currency pairs. Currency pairs involving major currencies have lower spreads.

Traders should also consider peak trading times for particular currencies. For instance, the cost of trading the Australian Dollar (AUD) will be higher during nighttime in Australia. This is because there are not as many market participants actively trading at this time. Similarly, other Australian financial markets that may influence forex are also closed at this time. A wider currency pair spread means that a trader would pay more when buying and receive less when selling.

High spread usually occurs during periods of low liquidity or high market volatility. For instance, forex pairs that include the Canadian dollar (CAD) will have lower liquidity during overnight hours in Canada. The same applies to exotic currency pairs such as the NZD/MXN which have a significantly lower trading volume.

Low spread in forex is the difference between the bid and the ask price. Traders prefer to place their traders when spreads are low like during the major forex sessions. Spreads are likely to be low when volatility is low and liquidity is high. When there is a bigger difference between the bid price (buy) and the ask price (sell), it means that traders are likely to spend more on wider spreads because of high volatility and lower market liquidity.